Spring is around the corner! I've been telling my clients that the real estate spring market starts in February so let me back that up with this market update. The temperature has been warming up and so has buyer demand. More new listings came to market in February and buyers have been quick to jump on the new supply. This month, new listings improved by about 13% compared to last year but inventory is still lower than what we saw last year. Why? Sales were up almost 23% on a year-over-year basis outpacing the new listings that were added to the inventory. The hot zone of supply shortage is in properties priced below $500,000 - there was very little selection for buyers searching in this price range - inventory of these properties was down 31% compared to 2023. The February benchmark price for all property types across Calgary is up 10% from last year, landing at $585,000. Let's break down each property type.

Spring is around the corner! I've been telling my clients that the real estate spring market starts in February so let me back that up with this market update. The temperature has been warming up and so has buyer demand. More new listings came to market in February and buyers have been quick to jump on the new supply. This month, new listings improved by about 13% compared to last year but inventory is still lower than what we saw last year. Why? Sales were up almost 23% on a year-over-year basis outpacing the new listings that were added to the inventory. The hot zone of supply shortage is in properties priced below $500,000 - there was very little selection for buyers searching in this price range - inventory of these properties was down 31% compared to 2023. The February benchmark price for all property types across Calgary is up 10% from last year, landing at $585,000. Let's break down each property type. DETACHED

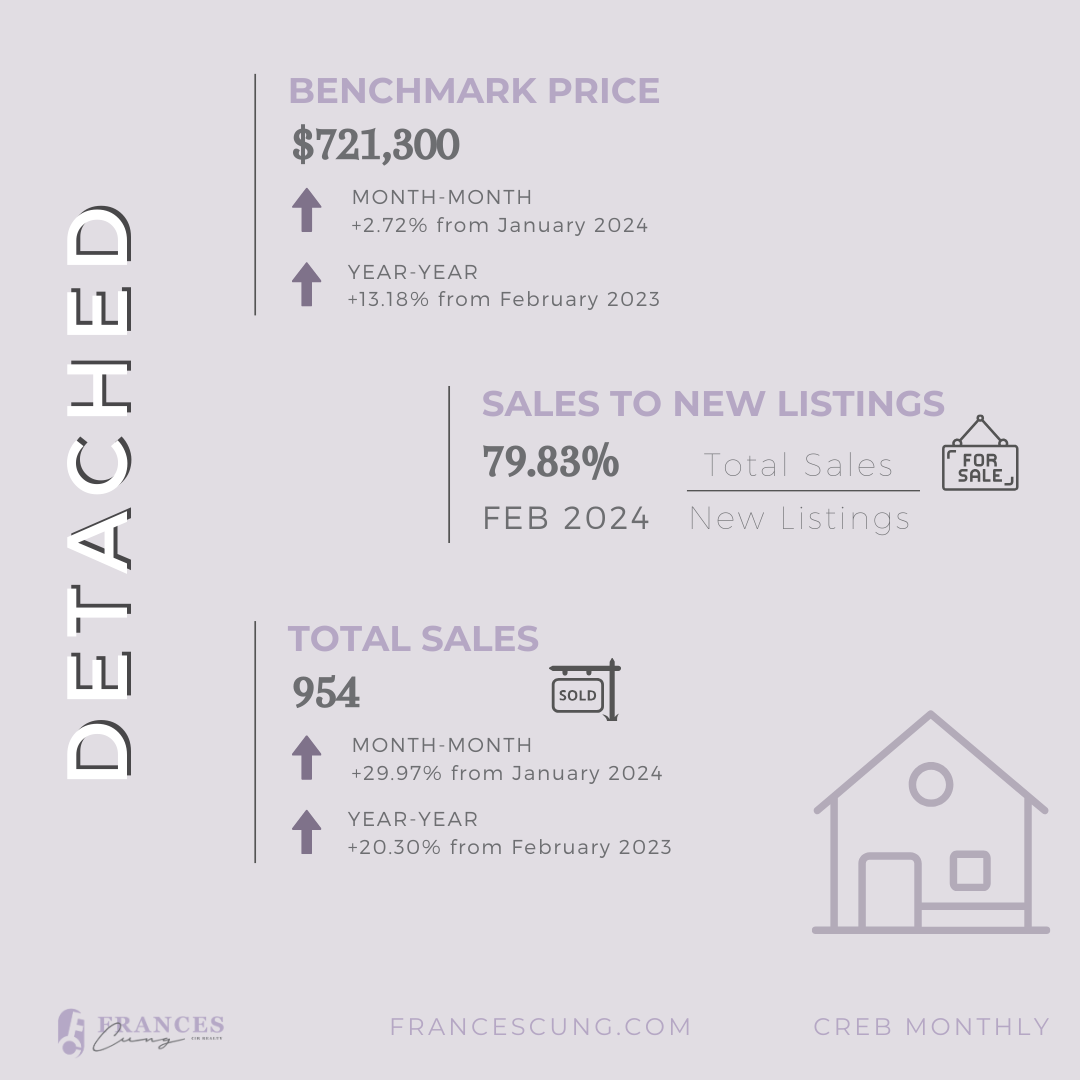

DETACHED

The low supply of detached homes is still having a hard time keeping up with the growing demand. February saw improved new listings but 75% of these were priced above $600,000. Calgary real estate market has noticeable seasonal trends throughout the year and February is when things start to pick up. With 954 recorded sales, we were up 30% from the previous month, and up over 20% from last year. Majority of these sales were priced between $550,000-$800,000. The tight market conditions continue to push upward pressure on prices in this sector. In February, the benchmark price pushed up 3% from January, and 13% higher than last year to land at $721,300. Price gains were recorded across all districts across the city, with the highest annual gain in Calgary's most affordable East

and NE districts.

SEMI-DETACHED

SEMI-DETACHED

The inventory cushion from January's new listings did not stick around very long. This month, there were 223 new listings and 191 recorded sales - pushing the sales-to-new-listings ratio right back up to 86%. The February benchmark price for semi-detached homes pushed a 2% monthly gain, and a 13% annual gain to arrive at $639,100. Year-over-year price growth ranged from a modest 10% increase in City Centre to a significant 26% gain in the East district. The S/NL ratio in the East district reached 125%, with many sales closing above asking price.

ROWS & TOWNS

ROWS & TOWNS

It was still a tight race between supply & demand for townhomes in February. It's been a very popular product type for the last 18 months! There were 457 new listings added to the market giving buyers some more selection. However, sales activity easily outpaced the new inventory. Sales were up almost 19% from the previous month, and 12% higher than the same time last year, keep the S/NL high at 77%. The February benchmark price for townhomes reach $434,500, more than 2% higher than the previous month and almost 19% higher than February 2023. Prices were up across all the city; the most significant annual price gains were in the East (up 37%) and NE districts (up 29%).

APARTMENTS

APARTMENTS

Apartment -style condos have finally earned their seat at the table - seller's market! And a tight one at that. With 638 recorded sales in February, we saw a YTD increase of 39%. There is a strong demand for more affordable properties and apartments fit the bill, relatively speaking. Inventory levels improved from last month, which is expected for this time of year but on an annual basis, inventory trended down 12%. Prices have consistently been coming up for the last 12 months. In February, the benchmark price went up 17% from 2023. Price gains were recorded in all districts. All districts saw Y/Y price gains between 19% in the SE and 34% in the East. All but the City Centre district (13% annual gain) where supply is more densely located.

Source: creb.com