Already time for another market update?! 2024 is off to the races! Sales in January showed a significant upswing compared to last year & were way higher than long-term trends. New listings came to market, giving more options for potential buyers and supporting more sales this month but market conditions are still extremely tight. As new listings trended up, so did the number of sales - so there was little to no change in the low supply levels. Most of the sales growth occurred for homes priced above $700,000. With 2150 units of inventory, this January saw the lowest inventory levels in the last 18 years; it was 49% lower than the long-term average for the month of January. The benchmark price for the month pushed up 10% compared to last year to $527,300. As usual, each sector performs a little differently. Let's break it down.

Already time for another market update?! 2024 is off to the races! Sales in January showed a significant upswing compared to last year & were way higher than long-term trends. New listings came to market, giving more options for potential buyers and supporting more sales this month but market conditions are still extremely tight. As new listings trended up, so did the number of sales - so there was little to no change in the low supply levels. Most of the sales growth occurred for homes priced above $700,000. With 2150 units of inventory, this January saw the lowest inventory levels in the last 18 years; it was 49% lower than the long-term average for the month of January. The benchmark price for the month pushed up 10% compared to last year to $527,300. As usual, each sector performs a little differently. Let's break it down. DETACHED

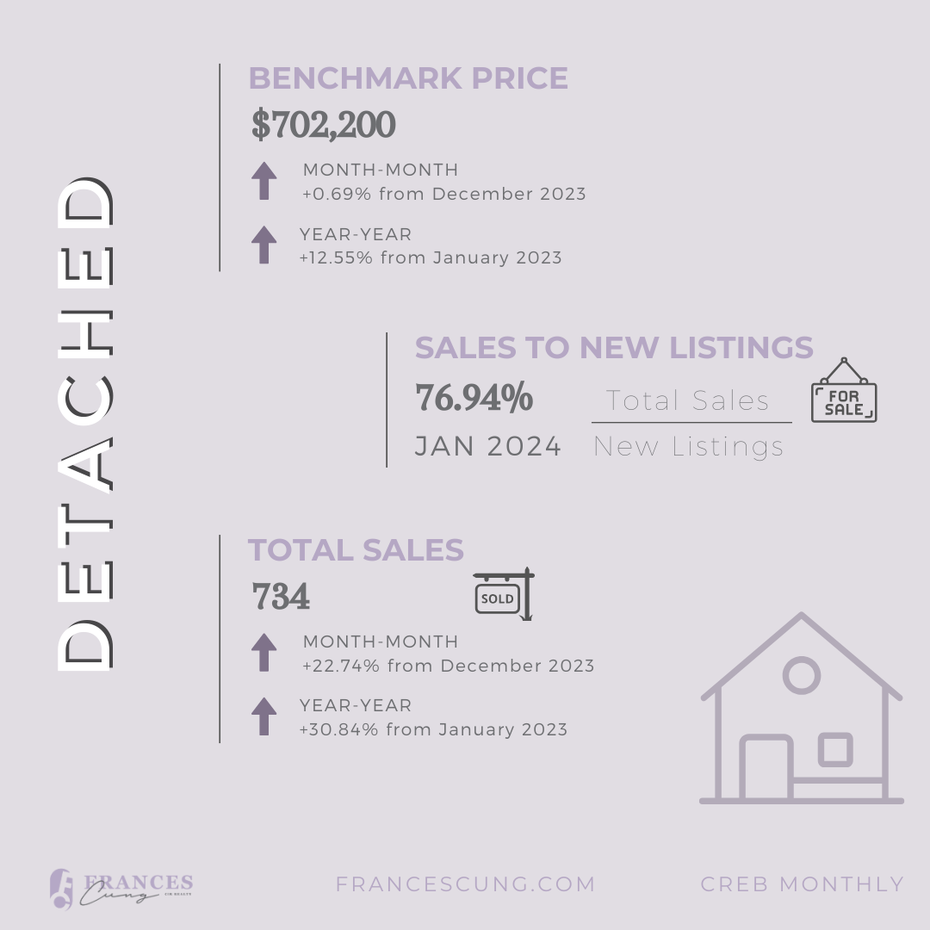

DETACHED

Inventory of detached homes has been short-stacked for the last 24 months. The start of 2024 was no different. Sure, there was a healthy boost in new listings but with a sales-to-new-listings ratio of almost 77%, it did not help the low supply levels by much. This sector is still sitting at 1.4 months of supply, putting upward pressure on prices. There were some more options for buyers looking for homes above $500,000 but most of the new listings came on north of $700,000. The benchmark price rose on a month-over-month and year-over-year basis. Price gains were recorded across the city, ranging from a low of 10% in the City Centre & SE districts to a high of 27% in the East.

SEMI-DETACHED

SEMI-DETACHED

There was some better news for buyers looking for semi-detached homes this month (although it might not feel like it). With 223 new listings and 131 sales, the S/NL ratio fell to its lowest since 2020 - we have been used to seeing an average S/NL of 82% for all of last year. This quick shift did manage to help the supply challenges in that ha riddled this sector for so long. That being said, although inventory improved slightly from last month, we are still well below long-term trends. The benchmark price pulled back just a smidge from the previous month but still remains more than 11% higher than in January of last year. The monthly pullback was driven by adjustments in the higher-priced West and City Centre districts.

ROWS & TOWNHOMES

ROWS & TOWNHOMES

Townhomes have been a hot commodity over most of last year and 2024 started with the same momentum. The rising prices for this property type must have caught the attention of some townhome owners because January also saw more new listings come to market. However, with 297 sales this month the S/NL ratio is still a whopping 92%. There was added supply but it was not enough to keep up with rising demand. The benchmark price in January reached $426,400, a modest gain from the previous month and almost 20% higher than January of last year. There were year-over-year price gains across all districts in Calgary.

APARTMENTS

APARTMENTS

Lots of action happening in this sector! Some buyers are turning towards more affordable product types, while investors are looking for income property to dive into the strong rental market. Out of all the property types, apartment-style condos saw the highest gain in sales. With 488 recorded sales, January sales were more than 22% higher than the previous month and 54% higher than last year. This was made possible because of the improved new listings that came to market in January compared to last month. The S/NL ratio was still at a high 76% so inventory levels are still 40% lower than long-term trends. The tight market conditions keep squeezing prices higher. The benchmark price of an apartment in Calgary reached $324,000, almost 1% higher than December and almost 19% higher than January of last year. Prices crept up across all districts but the biggest year-over-year jump was in the most affordable districts of East and NE Calgary.

Source: creb.com