The real estate market is a fickle thing - there are ups & downs and seems like it has a mind of its own. For the second month in a row, we are seeing the market shifting & correcting itself after 18 months of upswing. The intense bidding wars that we saw in the first half of the year seem further & further away. Even though sales activity slipped from the craziness that we saw in Q1 and Q2, the total residential sales in July are still well within the strongest levels recorded in Calgary's market. Benchmark prices have pulled back just a smidge month-over-month but the market is still much tighter than anything we've seen throughout the recessionary period before the pandemic. Looking into the future, we are expecting further rate gains that will weigh on housing activity but not enough to completely offset all of the price gains recorded since last year. There is a low supply of homes priced under $500,000 forcing some buyers to shift their focus towards more affordable options like townhomes & apartments. Meanwhile, there was a 20% increase of new listings of homes priced above $500,000 so conditions are becoming more balanced in the upper-end of the real estate market. Which segments are pulling the weight? Let's take a closer look.

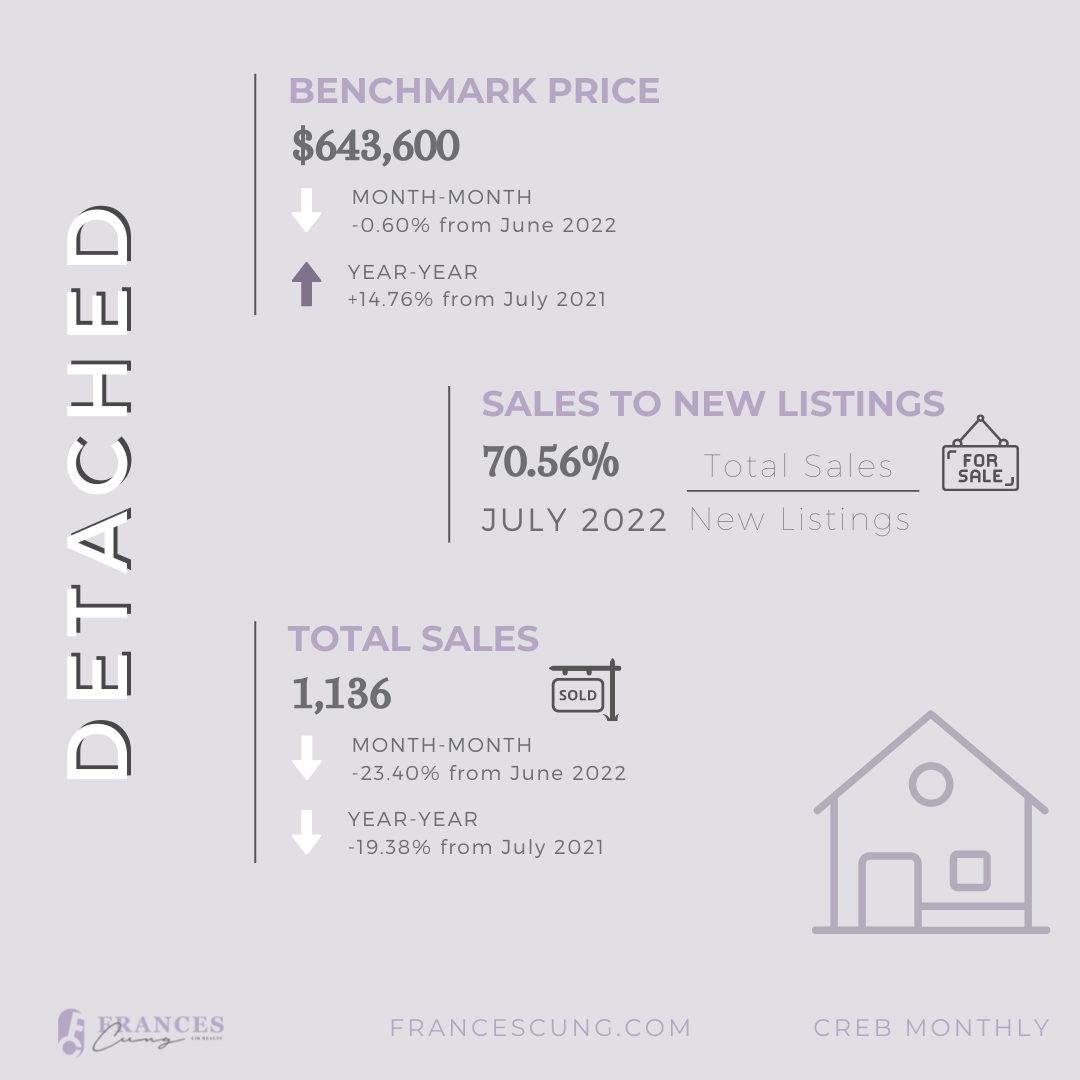

DETACHED

The shining star is seeing noticeable market shifts. Sales activity slipped from the previous month, and with 1,136 sales we are 19% below last year's sales levels. Increased lending rates have forced some buyers to look at more affordable property types. That being said, detached homes below $500,000 are still seeing very tight market conditions - there just aren't enough of these listings to go around. The decline in sales can be attributed to lack of inventory in lower price ranges. Almost 80% of available detached homes are priced over $500,000, and new listings that are priced under $500,000 are half of what we saw last year. Correction for lower-priced homes should be on the horizon. We are seeing monthly adjustments as prices trended down across the city in July.

SEMI-DETACHED

For the third consecutive month, the sales activity for semi-detached homes slip below the levels recorded in 2021. There were fewer properties on the market but not low enough to keep the months of supply from trending up. In July, semi-detached months of supply pushed up to 2.5 months - this is the first time it has pushed higher than 2 months since October 2021. Benchmark price slipped a tad from July to $576,900 but it is still 12% higher than it was same time last year.

ROWS & TOWNS

Sales activity for townhomes was not as high as we saw in spring but the sales in July reached a record high contributing to YTD sales growth of 54%. Most of the sales that drove this record were properties priced $300,000-$500,000 - which saw the biggest boost in new listings so far this year. There were fewer new listings recorded compared to Q1 but the gap between sales & new listings became smaller over the last few months. The sales-to-new-listings ratio rose to 87% for the month of July Inventory levels trended down and kept the months of supply under 2 months. The market conditions for this segment is still pretty tight compared to last year and prevented any meaningful adjustments this month. The benchmark price slid (by only 0.30%) to $362,600 but is still 15% higher than July of last year.

APARTMENTS

Apartments shared a similar story compared to townhomes this month. Sales levels slipped but is still in record high levels for July, contributing to a 66% YTD gain. New listings have trended down since March this year but is still 24% higher than last year's levels. This month's sales-to-new-listings ratio of 64% reflects relatively balanced market conditions. Price growth has slowed compared to the spring as well. Benchmark price rose slightly from last month to $278,800, but is almost 10% higher than it was the same time last year.

Generally speaking, the market is making its way towards more balanced conditions. Some property types are moving quicker than others but each month we are seeing small indications that the market is correcting itself. We are not crashing- but we are NORMALIZING. Because although it was a fun ride for many sellers this year, we can't possibly keep up with the bidding wars between 20+ buyers. It is still a complex market, by all means, but there may be some relief for more buyers in the market in the near future.

Source: creb.com